Author : (kadutz25)

My Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1097203

ETH Address : 0xdEC674B90e22c53B19569b54AD23F8c50CB4cF9C

What is Ceyron token (CEY)?

Token Ceyron is a Ethereum-based digital contract token that represents ownership of benefits in non-voting shares in the issuing company - Ceyron Finance Ltd. (CFL)

So basically the idea is to have services like Coinbase and Mastercard combined with the Proof of stake concept.

Holders of the CEY token will have:

Easy access to spend 20 fiat + cryptocurrency currencies is supported through The CEY Card (MasterCard physical, virtual, and debit with mobile apps for convenience) at a competitive cost.

Annual dividends (perhaps, not guaranteed): of some of the financial earning potential earned by the Fund - from their financial investments, to be exact.

Last but not least: high value tokens - CEY tokens - with a potentially stable and high portfolio of credit assets ROI

with integrity, safety, security, anonymity-safe and transparency in a high-performing decentralization system thanks to all the technologies that change the world: artificial intelligence, machine learning and, of course, blockchain.

Along with technological developments in our global world, major changes and developments also occur in banking and financial systems. In addition, with the tremendous spread of digital money, many regions of the world are affected by crypto money, from a series of sanitation to education and finance. But the situation is not the same in most parts of the world. The population of developing countries (Southeast Asia, Latin America and Africa) is more than 2 billion. Only Africa lives 1.2 billion people.

The use of cellular phones in Africa has increased from 130 million in 2005 to 900 million by 2015. Banks are gradually beginning to make mobile banking. In this framework, to develop online banking services, Al Party, to provide digital benefits to integrate millions of people into the official financial sector and to develop merchant payment services. Banks and Credit Union, the percentage of Africans who can not benefit from prepaid credit cards and financial services, fell from 95% to 60%. However, there are still many problems. Ceyron is a revolutionary financial cryptographic company. For more information about Ceyron, please visit our website. Now I will introduce you to the solution of this problem.

Investment objectives and strategies

The investment objective of the IMF is to provide attractive investment returns through a patented quantitative approach to provide asset loans, to be provided by Colombus Investment Management Ltd. The IMF will comply with data-driven investment strategies, where nonparametric statistical modeling engine is applied to the expected investment finance gains.

The net profit earned by the Fund during a particular month will generally be retained for reinvestment, but a portion of the potential periodic profit may be used to distribute the annual dividend to holders of the CEY Token, where such dividends are approved by the board of directors and shareholders with the right to choose CFL.

Loans supported by loan portfolios provide less volatility and cash flow

. A portfolio of credit assets will also be secured through a guarantee clause to improve stability and performance. Fund Managers will use artificial intelligence and machine learning to create a secure asset loan portfolio.

Blockchain technology enables efficient liquidity for investors

Blockchain technology has the potential to provide better integrity, security and transparency. Thus, CFLs will use blockchain to ensure the direct allocation of low-cost transactions in the hope of providing greater liquidity to investors.

Prepaid debit cards are efficient

The account holder has the ability to choose between multiple crypto used as a tender, and when making transactions (eg, dinner at a cost of $ 83.65), prepaid debit money will be used, or the holder can choose to use compatible cryptocurrency, which will then be sold with spot price to complete the transaction.

Level of competition

Because CFLs will have as much money as crypto power at any time, it can facilitate continuous cash exchanges in crypto to facilitate transactions, and enable CFLs to compete with Coinbase in services and tariffs.

CFL launched on

The market continues to grow The cryptographic market has grown over a hundred and sixty billion dollars ($ 160 billion) in the past year. Financial giants and central banks alike have invested in blockchain technology. Both large and small investors are looking for a more orderly market that allows safety nets and insurance coverage to be offered in the registered security market.

Approaching problems for developing countries

The population of developing countries (Southeast Asia, Latin America and Africa) represents more than 2 billion people. Only Africa represents 1.2 billion people. It's young and dynamic: 60% are under 50.

Banks are increasingly adopting mobile banking to:

developing online banking services;

take digital advantage for the parties to integrate millions of people in the formal financial sector;

developing commercial payment services

The banking level is low

According to experts, more than 2.5 billion people with low incomes and / or intermediate income are not related to the bank. Traditional agency models easily meet the needs of the poorest, yet no longer meet the requirements of the bank as a whole.

The reason for low bank penetration is found on two levels.

At the client level: most people have low or very low incomes and, therefore, have low storage capacity. While economic monetization has increased significantly since the 2000s, bank use has not been part of spontaneous practice. The emergence and rapid growth of powerful microfinance companies radically changed this situation.

At the banking level: the relative excess liquidity of banks is not an incentive for customer development. Weak population density adds to the average cost of the implementing agency.

A very competitive market

More than 75% of countries have the most services where mobile money services are available. This increased competition means that consumers have more choices. Some subscribe to two or three services simultaneously.

Very low usage rate

Africa is the world leader in the field of mobile money account. 2% of adults have mobile money accounts in the world, 12% holders are in Africa. Every year, the number of open mobile money accounts increased by an average of more than 40%. By 2020, the number of Africans with discretionary income - about 450 million people - will be comparable, if not higher than in Western Europe, with an average annual growth rate of 20%. By 2020, there will be nearly 800 million people who have mobile money accounts. Generates potentially nearly 10 billion transactions per day worth almost $ 135 billion by 2020.

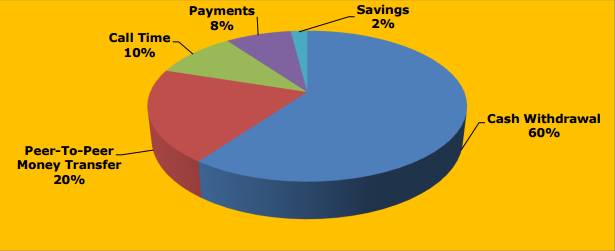

The analysis of user behavior payment methods appears to be a general trend: the withdrawal represents at least 60% of the volume of transactions; 20% of point-to-point transfer operations; call purchase time 10%, 8% payment and 2% savings.

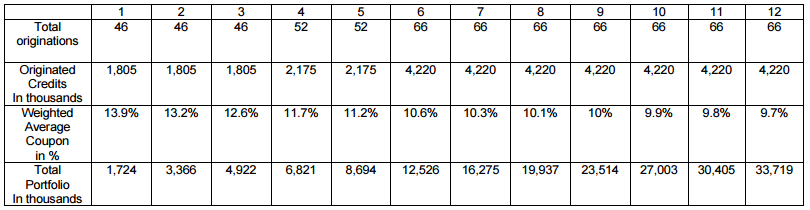

CFL Credit Portfolio

Currently, 60% (60%) of US mortgage loans. Their Act is in the hands of non-bank entities, compared to thirty percent (30%) in 2013. More than four billion USD ($ 4T) is only in US mortgages. Act They are available to choose from hundreds of banking credit platforms. The Fund Administrator is responsible for approving the solvency and risks associated with the platform and identifying the credit profile of the originating asset, from regulatory compliance with origination, volume, warranty, duration and level of quality of management and services. Fund Administrators will be assigned to select the highest performing assets available on this platform for the CFL portfolio, as well as eliminating the highest risk assets of the CFL portfolio.

Strategic alliance

The CFL strategic alliance is an established leader in blockchain, finance and banking technologies. CFL intends to sign a service contract with Coinfirm.io in respect of KYC / AML (Anti Money Laundering) controls for each token holder application. Ambisafe is a pioneer in blockchain technology and an ICO offer company that helps the world become more decentralized since 2010. His work is fundamental to projects such as Tether and Bitfinex. Recently, Ambisafe is behind the success of ICO. Loyal Bank is a registered bank under the laws of Saint Vincent and the Grenadines.

Market plan

The Offering of CEY Tokens in Saint Vincent and the Grenadines shall be made on the basis of the Securities Act release. The CEY tokens offered in this document (and the appropriate non-voting stock in CFL Ltd. owned by Nominee) will not be sold to others under any other offer in St. Petersburg. Vincent and the Grenadines except the terms of the FSA

The CFL shall provide a Memorandum of Offer to be prepared solely for use by a prospective CFL investor, to be issued by the CFL. The Offer Memorandum must be prepared in connection with a personal offer to an accredited investor, persons who must verify their status as an accredited investor through questionnaires and other required documentation, and others around the world who are eligible to participate in the jurisdiction to which they belong

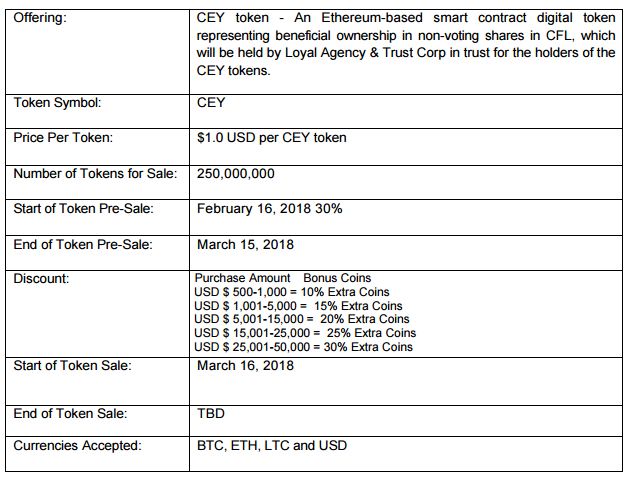

Offer summary

Potential investors will be asked for personally identifiable information when creating an account at ceyron.io to participate in the sale. This information is to ensure compliance with various securities laws in the United States and foreign jurisdictions, as well as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

For investors in the United States, they must comply with the obligations announced under "accredited investors" standards in accordance with Regulation D, Section 506 (c) of the Securities Act. An investor may indicate that he or she qualifies as an accredited investor by checking and loading documents in ceyron.io as described in the next section "Participation in the offer".

Sales and Distribution Token Ceyron (Cey)

The CEI symbol is a functional intelligent contract within the Fund. The CEY symbol is not returned. The CEY symbol is not for speculative investment. Future performance or value will not be promised or granted in connection with the CEI Document, including no pledge of natural value, no pledge of ongoing payment, and there is no guarantee that the CEI Doc will have any particular value. CEY rights are not an effect and they do not join the Company. The CEY symbol is not entitled to any rights in the company.

The CEI shares are digital markers to be provided to investors and represent a vested interest in a separate class of non-voting shares in Ceyron. The legal title of the representative will be withheld by Loyal Agency & Trust Corp ("LATC" or "Candidate") for icon owners, and marketers will have a useful interest in Ceyron Finance Ltd. not included in the management or operation of the Fund or Fund Manager described below.

CEY Token - offers smart digital contract signals representing lucrative holdings in the non-voting CEY section made by Loyal Agency & Trust Corp., which is trusted by the possession of the CEY Token.

Some information;

Token Name: Ceyron

Token: CEY

Price: USD 1.00 per CEY Token

Number of Tokens Sold: 250,000,000

Initial Sales of Pre-ICO: 16.2.18

Pre-ICO Ending: 15.3.18

Discount Before ICO: 30%, 25%, 15%

ICO Start: 3/16/18

Soft Cap: TBA

Hard Cap: TBA

Token Sales Results: When Hard Cap is achieved

Accepted Currency: BTC, ETH, LTC, and USD

Roadmap

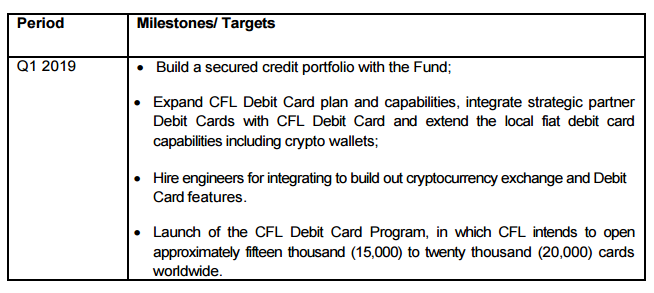

1 Quarter 2011

Create a secure loan portfolio with these funds;

Expect CEY Debit Card plans and capabilities, integrate strategic Debit Card partners with CEY Debit Card, and expand the capabilities of local fiat debit cards, including crypto purses;

Hire integrated engineers to make Crypto exchange and Bank Card features.

The launch of the CEY Debit Card Program, which CEY plans to open approximately fifteen thousand (15,000) to twenty thousand (20,000) cards worldwide.

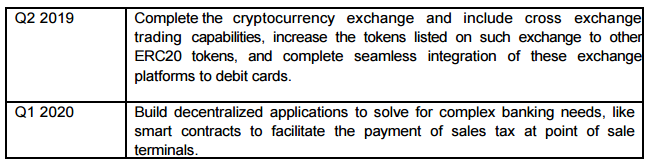

2019 Quarter

Complete the exchange of crypto exchange and add cross exchange trading capabilities, upgrade listed markers on the stock exchange to other ERC20 markers, and complete the perfect integration of this exchange platform to their debit card.

Quarter 2020

Create a decentralized app to facilitate the payment of sales tax at a point-of-sale terminal.

CFL management team

Executive Management

or more information, please visit the links below.

Website: https://ceyron.io/

Technical Report: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Facebook: https://www.facebook.com/Ceyron/

Twitter: https://twitter.com/cryronico

Instagram: https://www.instagram.com/cryronico/

Token Ceyron - Is Digital Token Intelligent Based Ethereal Contract

![Token Ceyron - Is Digital Token Intelligent Based Ethereal Contract]() Reviewed by leceng

on

Maret 22, 2018

Rating:

Reviewed by leceng

on

Maret 22, 2018

Rating:

Tidak ada komentar: